Is automation key to effective counter fraud?

The following is an extract from the Clue report Counter Fraud: Navigating the Path to Prevention, based on a survey of counter fraud professionals in government, public sector and law enforcement.

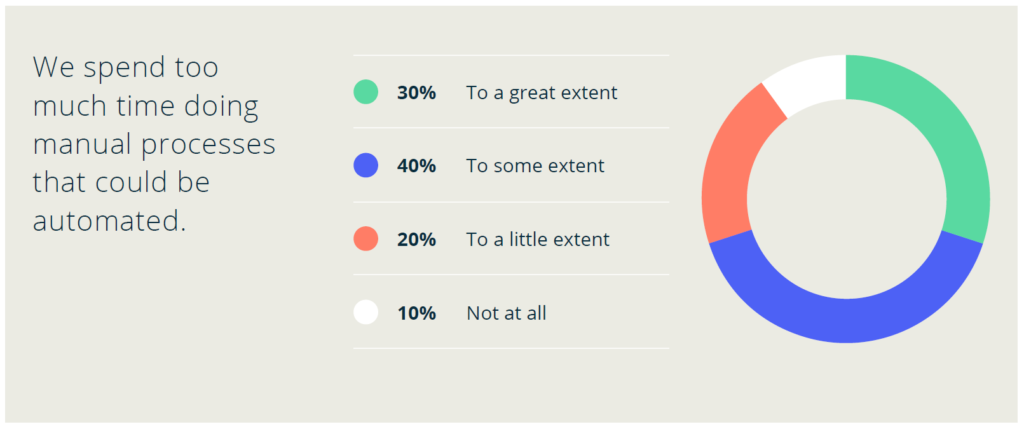

Admin and data entry tasks don’t tend to be what attracts investigators into the profession. But with three-quarters (75%) of counter fraud investigations teams reporting that time is easily consumed by manual processes, specialists are too often held back from doing what they signed up for.

That’s according to our counter fraud survey, which found that with more time being allocated to extracting data insights, stretched teams are exploring how automation technologies can relinquish resources, especially when combined with moving workflows into a single system.

A balanced approach to automation

However, the degree to which automation technologies are implemented must be balanced with the ability to configure tools and processes and retain human oversight of delicate investigations.

Respondents spoke positively of progress with controlled and measured approaches to automation. Projects include connecting interoperable systems to ease processing of unstructured data. Entities from documents, or notes, for example, can be automatically indexed and cross-checked against a ‘watchlist’ already known to the investigator.

Perceived rates of adoption are varied. One organisation reported their use of automation was already “slick”, for example. Another claimed they were exploring machine learning and AI techniques. Others admitted automation tools within current systems could be better utilised.

Using technology to manage the data we have could enable us to turn it from a threat to an opportunity. If criminals are making effective use of technology, we should be.

Survey respondent

Not only is unlocking investigators’ time crucial to shift the balance towards preventative counter fraud activity, but automation technology also offers advantages to active cases. Disclosure was regarded as a process ripe for automating resource-intensive data entry and redaction procedures.

Automating aspects of investigations and detection requires caution, however. Automation should be employed not to lead an investigator’s work, but to assist and support it.

In a field laden with sensitive information and profound consequences, it must be clear exactly how, why, and what decisions are being made by technology and where human decision-making must intervene. Transparency, auditability, and repeatability of all automated activity is key.

While a discussion around ethics is essential, however, organisations should not lose sight of the quick wins that are available.

Clue helps law enforcement agencies, corporations, public sector organisations and others detect and prevent economic crime.

Learn more about Clue for economic crime and enquire about a demo today.

Related Resources

Clue launches Economic Crime Threat Assessment 2025

Fraud and economic crime are escalating into a national resilience challenge. Clue’s new threat assessment sets out the scale of the problem - and how organi...

Learn more

Clue launches National Security Threat Assessment for 2025 and beyond

The UK’s security threats are converging faster than ever, and our new assessment outlines the top risks for 2025 plus practical steps every organisation can...

Learn more

What romance fraud can really look like – and why tech must catch up

Anna Rowe shared how emotional manipulation, fake online identities, and tech failures shaped her story - and why urgent change is needed to protect others.

Learn more

What's behind the rising insider risk and why does traditional security no longer suffice? Our latest Threat Assessment outlines an intelligence-led approach to detection and prevention, from national security breaches to ransomware.